How Can We Help?

How to run the Rejected Returns Report

How to run the Rejected Returns Report

SUMMARY

This article provides information on the Rejected Returns Report.

MORE INFORMATION

The IRS Rejections Report displays a listing of returns rejected by the IRS.

How to view the Rejected Returns Report

To generate the Rejected Returns Report, follow these steps:

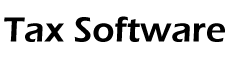

- On the Reports menu, point to Status Reports and then click Rejected Returns.

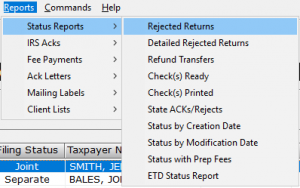

- In the Sort By list, choose the applicable sort option.

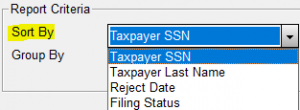

- In the Group By list, choose the applicable grouping option.

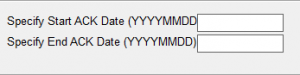

- In the Specify Starting ACK Date box, type the beginning acknowledgement date you want to run the report on in the MMDD format – for example, for January 1 type 0101.

- In the Specify Ending ACK Date box, type the ending acknowledgement date you want to run the report on in the MMDD format – for example, for January 1 type 0101.

- Click Quick View and then click Print.

Report Fields

The following information is displayed on the Rejected Returns Report:

Report Field

Description

SSN

Social Security Number

Last Name

Taxpayer Last Name

Date

Date of IRS Rejection

EFIN

Electronic Filing Identification Number

Center

IRS Processing Centers

EF ST

State return designator

Reporting Options

You can use the following report options when generating the Rejected Returns Report.

Sorting Options

You can sort the Rejected Returns Report by the following fields:

- Taxpayer SSN

- Taxpayer Last Name

- Reject Date

- Filing Status

Grouping Options

You can group information in the Rejected Returns Report by the following:

- Site

- EFIN

- Preparer

- Rejection Date