How Can We Help?

Reporting Actual Vehicle Expenses in SCH C

Reporting Actual Expenses in SCH C

This article will show you how to report actual vehicle expenses in Schedule C that is not mileage.

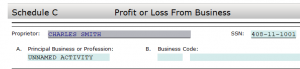

- After you add your SCH C

- Click Add Form

- Click on the last tab labelled Depreciation

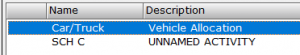

- Click Car/Truck Vehicle Allocation

- Click New Asset

![]()

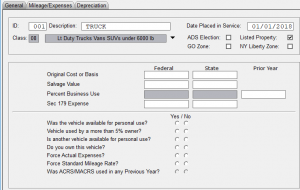

- Enter a description of the vehicle in the Description box and the Date Placed in Service

![]()

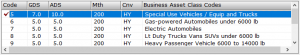

- Select the type of vehicle from the Business Asset Class Code

- Click OK

- Fill out the General tab with the information provided to you by the tax payer.

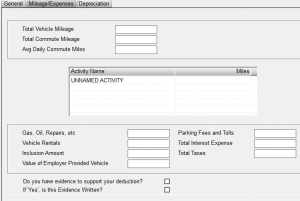

- Click on the Mileage/Expenses tab

- Enter a value of 1 in the Total Vehicle Mileage box

![]()

- Enter a value of 1 under Miles next to the Activity Name

![]()

- Now enter the expenses of Gas, Oil, Repairs, etc, Parking Fees and Tolls, Vehicle Rentals, Total Interest Expense, Inclusion Amount, Total Taxes, and Value of Employer Provided Vehicle with the information provided to you by the tax payer.

![]()

- Answer the following two questions “Do you have evidence to support your deduction?” and “If ‘YES’ is this Evidence Written?“.

![]()

- Click CLOSE

- In the Special Depreciation Allowance screen click OK

- Click Return to List

- Click Close

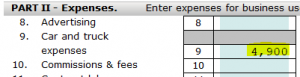

- Go to SCH C line 9 where you will see the total expenses you entered.