How Can We Help?

SSN already accepted

If you get a refusal from Central Site (CS) stating the SSN has previously been accepted, you can check to make sure if sent the accepted return with that SSN.

- Click on the Refusal to open the return.

- Return will open to the Information and Status page.

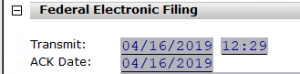

- Under the FEDERAL ELECTRONIC FILING bar you will see Transmit, ACK Date. If there is date in the Transmit that would be the date you transmitted the return to the IRS. If you see a date on ACK Date that is the date the return was Acknowledged by the IRS.

- If you have an ACK Date that means the return you transmitted to the IRS has already been Acknowledged and the reason you have a Refusal is because most likely it was transmitted twice to IRS.

NOTE: At this point you DO NOT have to do anything else as your return is already Acknowledged.